Download form and document related to RMCD. However at the same time not all products are necessary to be taxed.

Honda Malaysia Good News Sales Tax Exemption Has Been Extended Continue To Enjoy Great Savings With 0 Sales Tax On A Brand New Honda Now Visit Www Honda Com My For More Details

Ruler of States Federal of State Government Department Local Authority Inland Clearance Depot Duty Free Shop.

. The following person are exempted from Sales Tax. Sales tax is only applicable to taxable goods that are manufactured or imported into Malaysia. Guidelines Of 100 Exemption Of Excise Duty On Vehicle For Orang Kurang Upaya OKU Type Inability Physical Defects Dumb Hearing Defects Budget 2007.

The sales tax exemption is fundamentally similar to the tax holiday that Malaysians enjoyed between June to August 2018 during which the goods and service tax GST was zero-rated from all vehicle prices. The sales tax rate is at 510 or on a specific rate or exempt. Sounds good but will this result in a.

Any sales tax that falls due during a taxable period is payable to the Royal Malaysian Customs Department RMCD latest by the last day of the month following the end of the taxable period. The abovementioned Exemption Order refers to the Sales Tax Persons Exempted from Payment of Tax Order 2018. Exempt goods and goods taxable at 5 are defined by the HS tariff code.

If the application to vary the taxable. These include a 100 sales tax exemption on locally-assembled CKD models and 50 on fully-imported CBU models from June 15 until December 31 2020. Exemption from the Sales Tax under clause 99 Table B Sales Tax Order Exemption 1980 is a facility provided for the benefit of local factory operators that manufactures goods that are exempted from the Sales Tax which are meant for export and also on control items under the Ration Control Act 1961 which is bound under the.

The exemption is RM10000 or 10 of the chargeable gain whicever is greater. Malaysia Sales Service Tax SST. 3 rows Malaysia.

According to the release the sales tax exemptionan exemption that began 15 June 2022 for 100 of the. Application for Import Duty Exemption on. The Ministry of Finance on 20 June 2022 issued a media release regarding the sales tax exemption available with regard to the purchase of passenger cars.

However he said the registration period for the purchase of vehicles at the Road Transport Department RTD has now been extended until March 31 2023. Note that this is the first Policy issued by RMCD on Sales Tax matters. However the Malaysia Automotive Association MAA has since clarified that the tax-free reference only refers to import and excise tax and sales tax exemption only applies to CKD EVs.

The Schedule A of the Sales Tax Exemption from Licensing Order 1972 stipulates that manufacturers with an annual sales turnover of taxable goods not exceeding RM100000 are exempted from the requirement of applying for a sales tax licence. As you already know the government has announced that it will be waiving the 10 percent sales tax for locally-assembled CKD cars while imported CBU cars will see their sales tax reduced by half to 5 percent. Sales tax is charged by registered manufacturers of taxable goods and on the importation of taxable goods into Malaysia.

Any registered manufacturer to importpurchase raw materials components and packaging materials excluding petroleum exempted from the payment of sales tax formerly CJ5. The 10 percent sales tax still remain for imported CBU vehicles. Download the respective format.

Tax Incentive Scheme For Operational Headquarters OHQ Guidelines to Apply Discount On Contribution to Community Projects and Charity. Exemption from payment of sales tax Minister may exempt any person from payment of sales tax charged and levied on any taxable goods manufactured or imported Subject to conditions Approval on individual basis Exemption by Sales Tax Persons Exempted From Sale Tax Order 2018 Specific person or to class or category of person. Exported manufactured goods will be excluded from the sales tax act.

Find out more about their investment journey here. Importer may be exempted from payment of Sales Tax under Item 39 Schedule A of the Exemption Order upon re-importation of the pallets. Setting Up in Malaysia.

KUALA LUMPUR The deadline for the sales tax exemption for the purchase of passenger vehicles remains on June 30 2022 Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz said. The Malaysian authorities updated information. Such exemption is granted in the Sales Tax Exemption from Licensing Order 1972.

As a general rule goods are subject to sales tax at a rate of 10 however some goods are taxed at the reduced rate of 5 specific rates and others are specifically exempt. Manufacturer of specific non taxable goods exemption of tax on the acquisition of raw materials components packaging to be used. Class of person eg.

Sales tax exemption on purchase of passenger cars ends 30 June 2022. Disposal of part of the whole share owned by individual with effect from 31122015 If an individual dispose part of his entire share the exemption allowed is as follows. The sales tax exemptionreduction is applicable from 15-June to 31-December 2020.

A taxable period is a period of 2 calendar months however a taxable person can apply to the DG of Customs to vary the taxable period. The latter is not relevant at the moment because there are no CKD EVs on sale in Malaysia. GETTING READY FOR SALES TAX EXEMPTION APPLICATION.

Investor Highlights They came from all over but made Malaysia their home. Guideline on 50 Excise Duty Exemption For the. Item 1 Schedule C.

Best viewed in Google. For passenger cars in Malaysia there is a 100 sales tax exemption on locally-assembled CKD models and 50 on fully-imported CBU models for the period mentioned. Application for Import Duty andor Sales Tax Exemption on Machinery Equipment.

The move was made back then in anticipation of the re-implementation of the sales and services tax SST.

Sales Tax Exemption Bmw And Mini Malaysia New Prices Autobuzz My

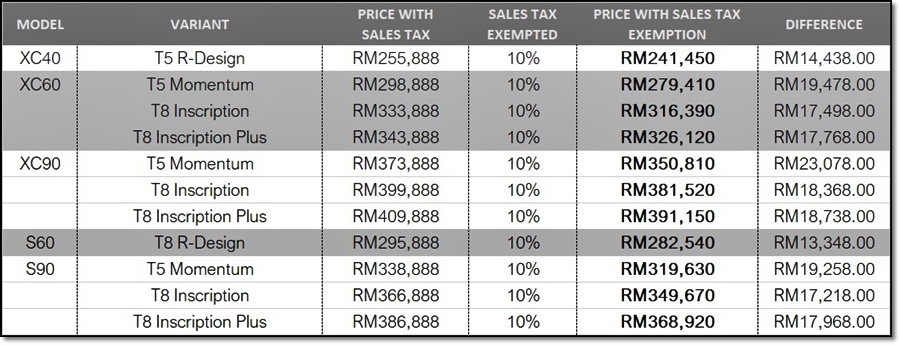

Sales Tax Exemption Volvo Revised Price List Announced Up To Rm23k Less Autobuzz My

Sales Tax Exemption Honda Malaysia S Revised Price List Autobuzz My

Gold Pound Symbol British Pound Symbol Isolated On White Paid Affiliate Sponsored Symb Como Economizar Dinheiro Simbolo De Libra Graficos Financeiros

Full Volvo Pricelist With Sales Tax Exemption News And Reviews On Malaysian Cars Motorcycles And Automotive Lifestyle

2021 Isuzu D Max Gets New 1 9l 4x2 At Plus Variant In Malaysia From Rm100 999 Rear Wheel Drive Only Paulta Isuzu D Max Rear Wheel Drive Commercial Vehicle

Bringing In Personal Car With Duty Tax Exemption Malaysia My

100 Sales Tax Exemption Extended Honda Tiong Nam Motor

Electric Car Market Share Financial Incentives Country Comparison Incentive Financial Share Market

Goods And Person Exempted From Sales Tax Sst Malaysia

Tax Exempt Exempt Specific Customers Groups

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

No 10 Drop In Car Prices Despite 10 Sales Tax Exemption Here S Why Wapcar

Sales Tax Exemption On Passenger Cars In Malaysia How Much Will You Save

Sales Tax Exemption To Continue Until End Of 2021 News And Reviews On Malaysian Cars Motorcycles And Automotive Lifestyle

Sales Tax Exemptions 50 For Cbu And 100 For Ckd Vehicles Autobuzz My

- undefined

- sales tax exemption malaysia

- kartun aiskrim malaysia

- contoh surat mohon sumbangan bantuan sekolah

- gambar hitam putih bulat

- daibochi plastic and packaging industry bhd

- jus buah naga merah

- corak wau bulan simple

- cara beli no plat

- cara nak buang bintik hitam di muka

- airpods black friday 2019 usa

- gambar hitam putih murid sekolah

- baby laki tag biru

- taman desa kiara tandop

- durio dulcis bunga merah

- doa lepas baca al quran

- mudah com kereta terpakai penang

- frame kayu kereta kecil

- contoh kepala surat penawaran

- j&t tracking number singapore